Microsoft EA vs CSP: Complete 2025 Guide

Why Choosing Between EA and CSP Matters More in 2025

In 2025, picking between a Microsoft Enterprise Agreement (EA) and the Cloud Solution Provider (CSP) program has become a pivotal decision for organizations. Microsoft is raising EA eligibility thresholds and phasing out EA for mid-market customers, which will fundamentally change the licensing landscape.

Many companies with fewer than 2,400 seats are finding that Microsoft will no longer renew their EAs, effectively withdrawing EA options for mid-sized enterprises.

Instead, these customers are being nudged toward newer models, such as CSP or the Microsoft Customer Agreement for Enterprise (MCA-E).

Why is Microsoft doing this? The company is pivoting to a cloud-first, partner-led strategy. CSP (and MCA-E) align with Microsoft’s goal of driving cloud subscriptions through partners, offering more flexibility and ongoing consumption billing.

Meanwhile, EA – long the standard for large enterprises – is being refocused on only the very largest, most stable customers. This shift means that in 2025 and beyond, enterprises must re-evaluate their licensing strategy.

If you used to rely on an EA but fall below Microsoft’s new seat thresholds or are embracing more cloud services, the choice of EA vs CSP is no longer business-as-usual. It’s a strategic decision that can impact your costs, support experience, and the smoothness of your adoption of new cloud technologies.

In short, Microsoft’s licensing evolution has made the EA vs CSP comparison more important than ever.

Companies need to understand the new rules of the game – who qualifies for an EA now, what advantages CSP brings, and how each model aligns with their IT and cloud roadmap. Let’s break down the critical differences and help you decide the best path for your organization in 2025.

Understanding Microsoft Enterprise Agreement (EA)

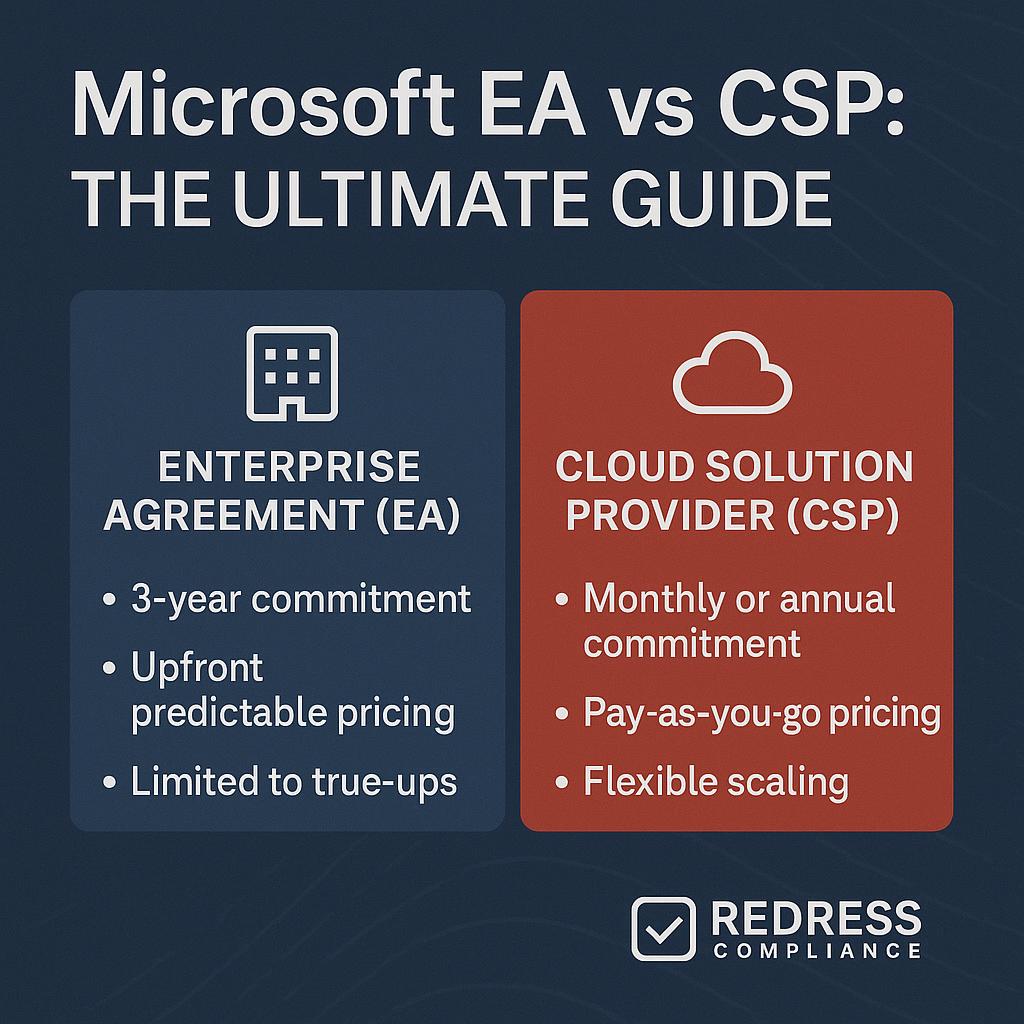

The Microsoft Enterprise Agreement (EA) is a legacy volume licensing program designed for large organizations. An EA is typically a three-year contract that covers a broad range of Microsoft products and services for a fixed term.

It was traditionally available to organizations with 500 or more users/devices, although recent changes in 2025 have informally raised the eligibility threshold (more on this later).

Here are key characteristics of an EA:

- Commitment and Term: You commit to a set of Microsoft software and cloud services for 3 years. This commitment locks in your pricing for that term, providing price protection. Many enterprises appreciate this predictable pricing – you know your per-user or per-product costs won’t increase over the EA term. Payments can often be spread out over the year (instead of a single large upfront sum), making budget planning easier.

- Volume Discounts & Fixed Pricing: Historically, EAs offered volume-based discounts. Microsoft had tiered pricing levels (A, B, C, D) – the more seats you licensed, the bigger discount off the list price you received. For example, an organization with 3,000 users might get better pricing (Level B) than one with 800 users (Level A). In practice, large EA customers could negotiate significant discounts beyond standard levels. However, note that Microsoft has announced the end of these programmatic volume discounts for online services by the end of 2025. This means going forward, EA customers of all sizes may pay similar list prices for cloud subscriptions, reducing one of the traditional advantages of the EA. That said, very large enterprises might still negotiate custom discounts, but the automatic tiered price breaks are being phased out.

- Software Assurance and Benefits: An EA typically includes Software Assurance (SA) on licenses, which provides benefits such as access to upgrades, training vouchers, planning services, and 24/7 Microsoft support for specific products. SA also grants hybrid use rights (like the ability to use a license both on-premises and in the cloud), which is valuable during cloud migrations. These benefits made EA a comprehensive package: you got not just the licenses, but also support and flexibility to transition to new versions or cloud services.

- Comprehensive Product Coverage: Enterprise Agreements encompass nearly all Microsoft offerings under a single umbrella. You can include traditional on-premises licenses (such as Windows, Office, Windows Server, SQL Server, etc.) as well as cloud services (including Microsoft 365, Office 365, Azure, Dynamics 365, and Power Platform, etc.). This one-contract approach simplifies license management for large organizations – everything is negotiated and tracked in a single location. It’s ideal for enterprises with a mix of on-prem and cloud needs, providing strong governance and a central view of compliance. EA customers manage their licenses through Microsoft’s portals (like the Volume Licensing Center and Azure Portal) with an established true-up process (an annual reconciliatory order for any increased usage).

- True-Up and Rigid Structure: With an EA, you generally commit to a baseline number of licenses at the start. Each year, you report any additional usage (e.g., you added 100 employees who need Office 365, or deployed more Windows Servers) and “true-up” by purchasing those additions so that your licensing is compliant. The EA’s terms allow adding licenses (you pay pro-rated for additions during the year), but you cannot reduce the number of licenses until the end of the 3-year term. This rigid structure means you’re paying for that initial commitment throughout the agreement, even if your needs drop. It ensures cost stability (you won’t pay less, but also you won’t pay more than expected aside from planned growth). For organizations with stable or growing needs, this isn’t an issue; however, for those who might downsize or rapidly shift their technology, it can lead to over-licensing.

- Negotiability and Legal Protections: Because an EA is a direct (or LSP-mediated) agreement with Microsoft, there is room for negotiation. Enterprises often negotiate custom terms in their EA, including pricing concessions, payment schedules, or contract terms related to liability, data residency, and other key aspects. There is also a single master agreement (often a Microsoft Enterprise Agreement or similar contract) that provides standardized legal terms. Many large companies prefer to have centrally negotiated terms, especially for matters such as data security or compliance requirements, rather than managing various third-party contracts. The EA provides a degree of legal protection and consistency because it’s Microsoft’s own contract framework.

EA Limitations in 2025: Despite its benefits for large enterprises, the EA is becoming less accessible or practical for others. Microsoft is actively phasing out EAs for smaller organizations.

If you have fewer than roughly 2,400 users, Microsoft is steering you away from EA unless you maintain some on-premises perpetual licenses within it. The rigid 3-year commitment can also be a drawback for businesses that demand cloud agility – you can’t quickly scale down to cut costs, and you might be locked into certain products for the term.

Additionally, as Microsoft promotes cloud subscriptions, some new services or special offerings may appear first in CSP or other channels rather than EA (although EA covers the vast majority of products).

Finally, the cost advantage of EA has eroded somewhat with the elimination of volume discounts and the regular global price adjustments Microsoft has been making – meaning EA customers must negotiate proactively to get good deals.

In summary, Microsoft EA in 2025 remains viable and beneficial for very large enterprises that value a predictable, centrally managed licensing program with multi-year stability.

It provides top-notch governance and the convenience of one agreement for all needs. However, mid-sized organizations are finding it harder to obtain or renew EAs, and the inflexibility and upfront commitment make EA a less suitable choice for cloud-driven businesses that prioritize flexibility.

Understanding Cloud Solution Provider (CSP)

The Cloud Solution Provider (CSP) program is Microsoft’s modern, cloud-centric licensing model delivered through partners. In a CSP arrangement, you purchase your Microsoft subscriptions from a certified provider (typically a reseller or integrator) rather than directly through Microsoft’s volume licensing.

CSP has gained prominence as Microsoft’s preferred channel for small and mid-sized businesses, as well as any organization seeking agility.

Key aspects of CSP include:

- Flexible Licensing & Terms: CSP offers pay-as-you-go flexibility. Unlike the fixed 3-year term of an EA, CSP lets you procure licenses on a monthly or annual subscription basis. You can usually choose month-to-month plans (which allow you to increase or decrease seats each month as needed) or annual commitments (which lock a price for a year but still let you adjust at renewal). There are even multi-year options for certain products (e.g., a 36-month subscription for some Azure plans or hardware Azure Stack), but the core idea is flexibility. No minimum seat requirements exist – you can have five users or 5,000; it doesn’t matter, as CSP is open to all. This makes CSP ideal for smaller organizations or those with rapidly changing business needs. If you need to scale user counts up or down frequently, or spin services up and down, CSP accommodates this without requiring a long-term contract.

- Billing and Consumption Model: Under CSP, billing is typically monthly, based on the usage or services you have subscribed to. If you add a user in the middle of the month, you’ll get a prorated charge. If you remove users (on a monthly-term subscription), your next invoice will be lower. This consumption-based model means you only pay for what you use on an ongoing basis. For annual subscriptions in CSP, you may pay upfront for the year or still be billed monthly, but you commit to a year. You can also align different subscriptions to co-terminate if desired. The CSP billing model in 2025 often leverages Microsoft’s New Commerce Experience (NCE), which standardizes the provisioning and renewal of subscriptions. One thing to note: monthly-term subscriptions typically cost about 20% more than committing to an annual plan (Microsoft has built in a premium for pure month-to-month flexibility). So, there is a premium for flexibility – organizations must weigh whether the ability to drop licenses at any time is worth the higher unit cost. Nonetheless, CSP’s billing approach provides far more granularity to align spending with actual usage, which is a significant advantage for cloud budgeting.

- Broad Product Availability: Through CSP, customers can access nearly the full suite of Microsoft cloud services – including Office 365/Microsoft 365 plans, Dynamics 365, Azure consumption, Power Platform, and more. In fact, almost all the same products available under EA are also available via CSP, with a few niche exceptions. CSP even offers some perpetual software licenses (for example, you can buy one-off licenses for Windows Server or SQL Server through CSP now, often with an add-on SA if needed), though this is less common. The key difference is that CSP is a transactional model – you order what you need, when you need it, rather than committing everything upfront. This makes CSP very well-aligned with cloud-first organizations that may not have a lot of on-premises dependency and prefer subscription licensing. It’s possible to run an entire enterprise IT environment via CSP subscriptions, from productivity software to cloud infrastructure.

- Partner-Managed Experience: When you go CSP, you are working with a Microsoft partner who manages the licensing and support for you. The partner handles provisioning your licenses, consolidating billing, and often provides support and advisory services. Microsoft entrusts CSP partners to be the frontline for customer service. This can be advantageous because a good partner can offer value-added services, such as monitoring your usage for optimizations, assisting with migrations, training your administrators, and handling support tickets on your behalf (escalating to Microsoft if needed). Essentially, you’re outsourcing some of the license administration to a specialist. Many organizations that lack large ITAM (IT asset management) teams appreciate this help. On the other hand, the quality of support depends on the partner – a weak partner could result in slower responses or less expertise. Additionally, with CSP, you typically don’t receive direct Microsoft Premier/Unified Support unless you contract it separately; instead, you rely on the partner’s support arrangements.

- No Lengthy Negotiation or Custom Terms: CSP operates under Microsoft’s standard Customer Agreement terms for cloud services, which are non-negotiable and typically require a click-through agreement. You typically sign a simple agreement with the partner. There isn’t a big bespoke contract to negotiate as with an EA. This streamlines procurement, but it also means there is less room to negotiate pricing or legal terms. Pricing in CSP is typically based on Microsoft’s published prices, although partners may offer a discount (often by reducing their margin), especially for larger customers or to secure new business. Some CSPs can provide competitive pricing – for instance, they might give 5% off Microsoft’s list price for Microsoft 365 to a good customer – but they have thinner margins than Microsoft’s direct sales. Hence, the discounts aren’t huge unless bundled with services. Legally, you’ll mostly adhere to Microsoft’s standard terms for warranties, liabilities, data handling, etc., rather than negotiating them case by case. For many mid-market companies, this is acceptable; larger enterprises might find the CSP model lacking in the robust contractual protections an EA provides (like liability caps or tailored privacy commitments).

- Agility and Cloud Alignment: CSP is designed to meet modern cloud needs. You can start new subscriptions in minutes, try out new Microsoft services easily, and align licensing with agile projects. For example, if a department wants to pilot a new AI-powered Microsoft service for 3 months, in CSP, you could just add those licenses for the team and then remove them if the project ends – you’re not stuck until an EA anniversary or trapped with unused licenses. This agility makes CSP very attractive as organizations constantly evolve their IT. Many new Microsoft offerings (like certain Azure AI services or niche SaaS tools) are readily accessible through the CSP marketplace. Essentially, CSP provides licensing as a utility that can expand or contract in line with your business needs.

However, CSP has its considerations too: It generally comes at a higher per-unit cost than an EA for those who would qualify for EA discounts.

Over a multi-year span, an enterprise with thousands of users might spend more under CSP because they’re paying closer to list prices each month rather than enjoying the lower rates an EA could lock in.

Also, CSP doesn’t inherently include Software Assurance – meaning if you still use on-premises software, you’d need to separately ensure you have upgrade rights or purchase SA a la carte on any perpetual licenses you buy.

Compliance management can also be a bit more fragmented: if you have a mix of subscription and legacy licenses, CSP won’t consolidate them the way an EA might.

You may end up managing cloud licenses via CSP and on-premises licenses via separate agreements (such as Open or MPSA), which can complicate tracking.

In summary, CSP offers unparalleled flexibility and simplicity for acquiring Microsoft licenses in 2025. It is ideal for small to mid-sized organizations, cloud-first companies, or any scenario where you need to frequently adjust your license counts or only pay for actual usage.

The trade-off is potentially higher long-term costs at scale and less customized contract terms. CSP shifts much of the responsibility to you (and your partner) to manage consumption wisely – but in return, you get agility and a service-oriented experience.

Microsoft clearly sees CSP (and the MCA-E for direct sales) as the future for many customers, particularly those who do not fit the traditional EA mold.

Pricing & Eligibility – EA vs CSP Side by Side

One of the most significant differences between EA and CSP is the qualification process and payment method.

Let’s compare eligibility and pricing for EA vs CSP in 2025:

Eligibility and Scale:

- Enterprise Agreement Eligibility 2025: Officially, EAs have required 500 or more users/devices to sign up. However, as of 2025, Microsoft’s effective stance is that only larger enterprises (typically those with 2,400 seats or more) should be on an EA. If you have fewer than ~2,400 users, Microsoft might refuse to initiate or renew an EA for you unless you include some on-premises components. In particular, customers who use EA solely for cloud services (such as Office 365) and are below the seat threshold are advised to switch to CSP or MCA-E. So, practically, the bar to get an EA has been raised significantly. If your organization is, say, 1,000 employees and currently on an EA that’s expiring, don’t be surprised if Microsoft tells you an EA renewal isn’t available – you’ll need to move to CSP. Larger enterprises (multi-thousand-seat companies, typically those in Level B or above previously) remain eligible and will likely continue with EA if it suits their needs.

- CSP Eligibility: There is no minimum size requirement for CSP. It’s open to all customers, from the smallest business to the largest enterprise (indeed, some Fortune 500 companies use CSP for certain purchases). Microsoft originally positioned CSP for SMB and mid-market, but it has matured to serve any organization that values flexibility. The only “eligibility” requirement is that you purchase via a Microsoft CSP partner (or directly from Microsoft in some regions under a similar structure). Because Microsoft wants to drive cloud growth, they are happy to let even large customers buy via CSP if they prefer. Although large customers may receive better deals through EA, it’s ultimately the customer’s decision.

Pricing and Discounts:

- EA Pricing Model: Under an EA, you typically negotiate a volume-based price according to your tier. As mentioned, if you were in Level A (500–2,399 users) you paid a certain rate, Level B (2,400–5,999) got a better rate, etc. Additionally, enterprise customers often negotiated special discounts on top – especially if they were committing to large Azure spends or premium products like Microsoft 365 E5. The EA also guarantees a price lock for 3 years on the licenses you initially commit to. Even if Microsoft raises the global price of a product, your EA pricing remains the same during the term (except for items like consumption-based Azure, which may have separate rules). This has been a huge benefit given Microsoft’s periodic price increases. In terms of cost structure, an EA typically has a significant Year 1 payment (for all your initial licenses) and then equal payments in Years 2 and 3, plus any true-up costs at anniversaries for added licenses. With the removal of formal volume discounts by the end of 2025, EA customers moving forward might effectively pay Level A pricing for online services across the board. That means some larger EA customers will see cost increases when they renew, as they lose the automatic discount for having thousands of seats. Nevertheless, EA customers can still aim to negotiate custom discounts or incentives – especially if they’re a strategic large account for Microsoft (for example, committing to Microsoft Azure spend can sometimes get you extra discounts or credits).

- CSP Pricing Model: CSP is generally paid per license at the list price (MSRP), with per-use pricing for Azure. Microsoft sets a standard price list for CSP partners. Partners can choose to offer a small discount or bundle their services, but you’re usually looking at near-list pricing. There are no built-in volume discounts: buying 50 licenses or 5,000 licenses in CSP doesn’t automatically change the unit price (every license is essentially a Level A price). However, CSP occasionally offers promotional discounts on select products, and partners may pass these savings on to you. Also, if you commit to annual terms for user licenses, you lock that price for the year (protecting against Microsoft’s price hikes during that term). Azure under CSP often has the same rates as buying directly from Microsoft’s pay-as-you-go model, though some partners may optimize costs or offer credit if you commit to a certain spend. In 2025, Microsoft aims to standardize pricing globally, which may result in adjustments to CSP prices in local currencies; however, these changes will affect EA and CSP similarly. An interesting angle: CSP can actually be cheaper for some mid-sized customers in the short term. If you only need, say, 600 Microsoft 365 licenses and might drop to 550 next month, CSP could let you pay exactly for 550-600 users as needed. In EA, you’d have committed to around $ 600 for three years, regardless.Additionally, CSP partners may offer support or migration services at no cost, which has value. That said, for large, steady-state usage, EA has historically offered better pricing. As volume discounts end, the gap narrows. However, large enterprises can often still negotiate better overall pricing via EA (and avoid the 20% premium on monthly flexibility by sticking to a fixed count).

Cost Modeling Considerations:

When comparing costs, you have to consider your usage pattern. EA is more cost-effective if you have a consistent or growing need for Microsoft licenses and can negotiate a favorable discount. You’ll pay a fixed annual amount that you budget for, and any growth is typically at the same unit cost. You are protected from sudden price increases for the duration of the term. CSP is cost-effective if you expect fluctuations or are not sure about adoption. You won’t pay for unused licenses because you can drop them. But if you keep a stable high number of licenses over 3 years, CSP will likely end up costing more than an EA would have, because you paid full price every month and possibly endured any price hikes Microsoft implemented along the way.

Another factor is Software Assurance (SA) costs: In an EA, SA is built into the pricing for certain products, such as Windows or Office licenses. In CSP, if you require equivalent rights (such as running Office on-premises or making upgrades), you may need to pay extra or maintain separate agreements. Those hidden costs can add up when transitioning from EA to CSP, especially if you have on-prem servers that require SA for upgrades or hybrid use.

Who Should Be on EA vs CSP in 2025: As a general rule, organizations still qualifying for EA (2,400+ seats or a mix of products that mandate EA) should carefully weigh the benefits of staying on EA for pricing stability. If you’re a huge enterprise with thousands of users, an EA can still yield lower per-user costs, and you can negotiate multi-year cloud discounts. Everyone below that threshold should plan for CSP or MCA-E, because Microsoft is essentially not giving a choice. For these mid-market enterprises, the strategy should be to optimize CSP costs. This can be achieved by negotiating with a few CSP providers to obtain the best quote, considering annual commitments for core products to avoid premiums, and leveraging the flexibility to continually right-size licenses.

Also note that if you have global operations, an EA has historically simplified multi-country licensing under a single agreement. CSP can also handle multi-geography needs, either through a single partner or multiple local partners. Pricing can differ by region in CSP if currency conversion is involved. Under EA, pricing was often uniform in one currency for the whole org (with local affiliates signing under it). This nuance might affect very large companies with global offices.

In summary, the EA vs. CSP pricing comparison comes down to commitment versus consumption. EA rewards commitment with predictable costs and potential discounts, whereas CSP charges purely on consumption with flexibility but at standard rates.

As Microsoft levels the playing field on pricing, the decision becomes more influenced by your operational preferences and eligibility than by simple cost differences.

Flexibility vs Predictability

A key trade-off between EA and CSP is the balance between flexibility and predictability. This touches on how each model handles changes in your usage and budget stability:

- Enterprise Agreement – Predictability: With an EA, you get a high degree of cost predictability. You commit upfront to a certain volume of licenses, and you know what your annual spend will be for the next three years. This predictability is valuable for budgeting in large enterprises – CFOs and procurement teams like that there are no surprises. Additionally, because pricing is locked, you are insulated from market fluctuations (even currency fluctuations if your EA is in a set currency) and Microsoft’s own price hikes. For example, if Microsoft raises the price of Office 365 by 5% next year, EA customers typically will not feel the increase until renewal time.In contrast, CSP customers may see the increase once their annual term is up or even immediately for month-to-month subscriptions. EAs also allow some predictability in planning deployments: you know you have X licenses available across the company, and you true-up annually if you exceed that – there’s a structured rhythm. This stable framework is ideal for organizations with steady growth and long-term projects. You won’t have to constantly adjust licensing, allowing you to focus on other IT management tasks. However, the flipside of that predictability is rigidity. In an EA, if you overestimated your needs and committed to too many licenses, you generally cannot scale down and reduce costs until the EA term is over. You’re essentially locked in. That could lead to paying for unused capacity. For instance, if your company planned for 2,000 users but a division was sold and you dropped to 1,800, you still pay for 2,000 under EA until the next renewal. In 2025’s volatile business climate, this is a real risk. Layoffs, divestitures, or faster-than-expected cloud migrations could leave you over-committed. So, while EA gives price security, it requires a careful prediction of needs.

- CSP – Flexibility: CSP shines in operational flexibility. You can adjust your licensing on a month-by-month basis. This means that if you have a contraction in staff or finish a project and no longer need certain licenses, you can reduce them and immediately save money in the next billing cycle. It’s very attractive for organizations that experience seasonality or uncertain growth. Also, if you need to ramp up quickly – say you acquire a company or start a new initiative – you can add licenses in CSP immediately without negotiating a new contract or waiting for a true-up date. Flexibility in CSP extends to term lengths, too: you aren’t forced into multi-year commitments. If you only need a service for 6 months, you can pay for 6 months and then cancel it. This on-demand model aligns well with agile and DevOps methodologies, where IT wants to deliver value quickly and adapt continuously. The downside of flexibility is cost variability and potential unpredictability in spend. With CSP, your monthly bills can fluctuate. It’s on you (and your partner) to monitor and forecast usage to avoid budget surprises. If your organization isn’t disciplined about removing licenses not in use, you could end up paying for sprawl just like under EA – except there’s no true-up to reconcile; the meter is always running. Moreover, while you can drop licenses, if your usage actually grows, you might end up spending more than you would have under an EA’s fixed rate. There’s also the risk of escalating costs: if Microsoft implements price increases or if foreign exchange rates change (for non-USD currencies), your CSP costs can rise year over year, making it harder to predict long-term budgeting. In essence, CSP demands active management to ensure flexibility translates into efficiency. If unmanaged, it can feel as unpredictable as leaving the lights on with a running meter.

Striking a Balance: In 2025, many larger organizations are considering a hybrid approach to balance these factors: maintaining an EA for core, predictable needs (ensuring a stable base cost) and utilizing CSP for variable or innovative needs where flexibility is paramount.

For example, a company might keep its main Microsoft 365 licenses under EA (since every employee needs email and Office constantly), but use CSP for ancillary Azure services or for a subset of users in experimental projects. This way, they get the best of both: the EA provides a predictable backbone, while CSP provides agility at the edges.

In summary, choose EA if you prioritize stable, predictable costs and don’t expect to downsize significantly. Choose CSP if you value flexibility and the ability to closely align usage with costs, and can effectively manage those costs. It’s a classic stability vs agility decision.

Support, Governance & Compliance Differences

Beyond cost and flexibility, EA and CSP differ in how support is delivered and how licensing governance is handled, which in turn affects compliance management:

- Support under EA: Traditionally, an EA customer would either rely on Microsoft’s support offerings (like a Premier Support or the newer Unified Support, which is typically an add-on service contract) or on their Licensing Solution Provider (LSP) for basic license issues. The EA itself doesn’t automatically come with comprehensive support for everything – you often purchase a support agreement separately. However, EA customers did enjoy some perks: for instance, Software Assurance provided a limited number of support incidents and training days, and they had a dedicated Microsoft account team or LSP representative to assist with their needs. Additionally, since you have a direct agreement with Microsoft, any escalations related to licensing or product issues can be handled through your Microsoft account managers. EAs also include access to tools like the Volume Licensing Service Center (for download keys, managing licenses), and you often get a license statement that helps in compliance audits. From a governance standpoint, EAs establish a structured process (such as annual true-ups) that encourages organizations to regularly review their usage and maintain compliance. Audits (Microsoft license compliance audits) are typically easier to manage under EA, as all entitlements are clearly documented in a single agreement.

- Support under CSP: In the CSP model, your primary support comes from your partner (reseller). The CSP partner is responsible for helping you with issues, whether it’s a billing question or a technical problem with a cloud service. Good CSP partners offer 24/7 support and have escalation routes into Microsoft if there’s a complex issue (since partners have their own partner support liaison with Microsoft). Some partners include basic support as part of your subscription; others offer tiered support plans. One clear advantage of CSP is that you effectively get partner consulting and administration as part of the package – the partner can handle user adds/removals, troubleshoot licensing assignment issues, and advise on license optimization. This outsourced admin model can be a relief for small IT teams.On the other hand, you are one step removed from Microsoft: if something major goes wrong (such as a service outage), you communicate with your partner rather than directly with Microsoft. Additionally, not all partners are equal – some may not have in-depth expertise in specific Microsoft products, which could impact the quality of support. When it comes to governance, CSP puts more onus on the customer (and partner) to manage licenses continuously. There is no yearly true-up ritual; instead, you must continuously ensure you have the right amount of licenses. Compliance is generally straightforward for cloud services (if you have a subscription for 100 users, you can only assign it to 100 users – so overuse is naturally controlled). However, suppose you are using on-premises benefits via CSP subscriptions (for example, Windows 10 Enterprise E5 via CSP grants you the right to deploy it on-premises or with Windows Server subscriptions via CSP). In that case, you need to track those deployments internally – Microsoft could still audit your usage of those on-prem components. One challenge is that CSP agreements don’t cover on-prem Software Assurance. Suppose you have significant on-prem investments and need SA (for upgrades or license mobility). In that case, you might need to maintain a separate agreement, such as an Open Value or per-software SA, which complicates compliance tracking.

- Legal and Contractual Governance: An EA is governed by a negotiated contract that may include custom clauses. For instance, large companies often insert clauses around data privacy, regulatory compliance, or specific termination rights. In contrast, CSP is governed by the standard Microsoft Customer Agreement, as well as any additional standard terms the partner may have. Legal protections in EA can be strengthened – e.g., liability limitations, GDPR-related commitments, etc.- and detailed. CSP’s standard contract is uniform and not really negotiable per customer. If your enterprise has strict legal requirements, an EA might feel safer. That said, Microsoft’s standard terms in the customer agreement are fairly comprehensive for most needs and are used by thousands of companies.

- Compliance and Audit: Under an EA, Microsoft has clear rights to audit your usage, but since you self-report usage changes annually, there’s a level of trust and routine. Audits often focus on on-premises software usage (like Windows/Office installations, server CALs, etc.). Under CSP, since most things are cloud subscriptions tied to Microsoft 365 or Azure, compliance is largely automatic – you either have the subscription or you don’t. There’s less risk of accidental over-deployment of cloud licenses. However, a potential compliance risk is if an organization mistakenly believes something is included when it isn’t (for example, using a feature not covered by their license edition). In CSP, without a large Microsoft licensing team guiding you, it’s possible to misconfigure something. Your partner should ideally catch that. Microsoft can still audit for compliance, especially if you mix in any perpetual licenses (which might be outside of CSP).

In summary, EA provides centralized governance and a direct line to Microsoft, along with a formal structure for compliance. In contrast, CSP offers a partner-led support model that can be highly hands-on and convenient, but this level of support varies by provider.

Your internal licensing maturity matters here: If you have a strong SAM practice, CSP will feel fine; if you relied on Microsoft and LSP to guide you, you’ll need to ensure your CSP partner fills that role adequately.

Cloud Adoption – EA vs CSP

As organizations continue their cloud journey (with Azure, Microsoft 365, and emerging AI services), the choice of EA vs CSP can influence the cloud adoption experience:

- EA’s Hybrid and Cloud Transition Benefits: Enterprise Agreements were originally built in a world of on-premise software, but they have evolved to support cloud. One big advantage for cloud adoption under EA has been the availability of transition SKUs and hybrid rights. For example, if you had lots of Windows Server or SQL Server licenses with SA, you could use the Azure Hybrid Benefit to run VMs in Azure at a reduced cost – and these on-prem licenses could be part of your EA. Similarly, moving from Office on-prem to Office 365 under an EA often meant using “From SA” license SKUs, which gave a discount (recognizing your past investment in perpetual licenses). Microsoft also introduced offers, such as Office 365 E3 from SA or EMS from SA, at approximately 15% off for EA customers transitioning to cloud services. These kinds of incentives made EA a convenient vehicle for cloud migration: you could swap some of your on-prem entitlements for cloud subscriptions at renewal and get loyalty discounts. Additionally, Software Assurance in EA provides rights such as Dual Use (allowing simultaneous use of on-premises software while transitioning to online services) and license mobility (the ability to bring licenses to cloud environments). All of this gives EA customers a lot of leverage to adopt cloud on their terms, gradually and cost-effectively. For Azure specifically, EA customers often have an Azure monetary commitment or an Azure plan under their EA, which offers discounted rates if they pre-commit to a certain spend.

- CSP and Cloud-First Agility: CSP is inherently cloud-first. If an organization wants to dive straight into Microsoft’s cloud offerings without the baggage of legacy licensing, CSP is an excellent route. Need some Azure resources? You can set up a CSP Azure plan and start consuming instantly, paying monthly for what you use. Need Microsoft 365 for a new batch of users? Add those subscriptions via the CSP portal easily. CSP’s strength in cloud adoption lies in speed and simplicity – you don’t need to wait for a lengthy contract negotiation or a true-up cycle. This is particularly useful for trying out new Microsoft cloud products (like, say, a new Power Platform service or the latest AI-powered add-on for Teams). CSP also allows for small-scale piloting: you could deploy a new service to 50 users as a trial for 2 months, then decide to scale it to 500. Under an EA, you might have had to either commit for the entire year or navigate complex terms to do a short pilot. So CSP accelerates time-to-value for cloud initiatives.

- Migration and Dual Operations: One key consideration is whether you have a hybrid environment (with some workloads on-premises and others in the cloud), and how each model supports this scenario. EA is strong here: because you can include both on-prem and cloud under one agreement, it’s easier to manage a hybrid licensing scenario. For example, you might still be using Windows Server CALs under EA while also using Microsoft 365 for cloud services; all of it is part of the same true-up/management process. If you move to CSP entirely, those on-prem needs might have to be handled separately. CSP does offer some on-premises licenses (such as Windows Server Subscription or SQL Server Subscription), which are essentially subscription versions of these products. However, they may not cover all scenarios or may be more expensive than a traditional EA/SA agreement for on-premises solutions. Additionally, certain migration benefits (such as a discounted step-up from an older product to a newer cloud service) may not exist in CSP in the same way. CSP assumes you start subscriptions from scratch. If you’re coming off an EA, you might lose things like that 15% from SA discount on Microsoft 365, effectively making cloud licenses pricier if you hadn’t transitioned during your EA.

- Azure Consumption and AI: If your strategy involves heavy Azure usage, both EA and CSP can accommodate it, but in different ways. Under EA, many organizations enter into an Azure commitment (e.g., committing to spend $1M on Azure over 3 years, which may come with a discount or an upfront monetary credit). They then burn down that commit as they use Azure. CSP for Azure is a purely pay-as-you-go model, although some CSP partners may offer their own discounts or optimization services. One consideration: large Azure consumers sometimes prefer EA for the billing predictability and because they can negotiate directly with Microsoft for better rates or Azure credits. CSP’s advantage is if you want a partner to help manage and optimize your Azure (cloud solution providers often have cloud management platforms to help keep your Azure spend efficient). In terms of AI upsells (think new Microsoft AI services, e.g., Azure OpenAI, or AI add-ons in Microsoft 365 like Copilot), Microsoft will likely make them available across both EA and CSP. CSP might give you the ability to try them on a few users easily. EA may require you to place an order or add to your agreement, which could result in a slower process. But functionally, there’s no difference in the tech you get – it’s about how you order it and pay for it.

In summary, for a phased cloud adoption, an EA provides a structured path with hybrid benefits and discounts, allowing for gradual migration. In contrast, a CSP enables fast, incremental adoption of cloud services with minimal bureaucracy. Organizations that are all-in cloud from the start will find CSP very natural.

Those who are transitioning from heavy on-prem footprints might appreciate the bridging benefits an EA offers for one more cycle.

Keep in mind Microsoft’s direction, though: they are investing in making CSP and MCA-E robust for enterprises, so more and more of those transitional perks could find their way to non-EA programs over time.

Strategic Scenarios: Which Model Is Best for You?

Every organization is unique, but here are some common scenarios to help illustrate whether EA or CSP (or a mix) might be the right fit:

- Large Enterprise (approximately 2,400+ seats, stable IT needs): If you’re a Fortune 1000-size company or larger, with thousands of employees and a relatively predictable IT environment, the Enterprise Agreement remains a strong choice (assuming Microsoft still allows you to renew one, which they likely will if you meet the criteria). You likely value standardization and long-term planning, and you have the clout to negotiate good terms. An EA will give you budget stability for three years, possibly better pricing per unit, and the convenience of managing a single contract. You also likely have a dedicated Microsoft account team and maybe an EA reseller partner who can assist – so you’re not lacking support. In this scenario, EA’s rigidity is less of a problem because you foresee growth or steady state, not reductions. And suppose you do need a bit of flexibility. In that case, you might consider incorporating a dual strategy: retain the EA for 90% of your needs, and utilize a CSP partner for the remaining 10% of things that are experimental or require separate handling for subsidiaries. Many large companies do maintain a small CSP relationship for specific projects or regions, while keeping the bulk in EA.

- Mid-Market Company (500 to ~2,400 seats, especially cloud-focused): This is where things have changed dramatically. In the past, an organization with 1,000 users would almost always be on an EA. Now, Microsoft is essentially phasing EA out for this segment. If you fall within this range, you should probably plan to switch to CSP (or the Microsoft Customer Agreement route) either at your next renewal or soon. The best approach is to treat CSP as inevitable and turn it into an advantage. Start evaluating CSP partners early – look for one that offers competitive pricing, but more importantly, great support and expertise, because they will be your guide. Additionally, plan for transitional pricing: if you have enjoyed special EA pricing or discounts, be aware that your costs may rise in the first year of CSP. Negotiate with the CSP partner to potentially offer a first-year discount or have Microsoft provide an incentive (Microsoft sometimes offers bridge discounts through partners in specific cases). For mid-sized organizations, CSP can actually simplify things – you likely don’t have a huge licensing department, so having a partner co-manage it can be a relief. Ensure you have executive buy-in that moving to monthly billing and possibly variable costs is acceptable. You’ll want to implement internal processes to review the monthly CSP bills and keep them under control. In this scenario, EA might only still be viable if you have a lot of on-prem servers with SA – but even then, Microsoft might push you to a combination of CSP + Open Value for those servers.

- Cloud-First, High-Growth Organization: Think of a tech startup that’s grown to 300 employees and expects to double in a year, or a modern company that is 100% on Azure and Microsoft 365 with no legacy footprint. For these, CSP is a no-brainer. It offers the flexibility to add users as you hire them (or remove them if needed), and you pay monthly, which is great for cash flow in a high-growth or uncertain environment. There’s no point in an EA because you might not meet the seat minimums, and you don’t need the old-school features of EA. Also, cloud-first companies often utilize multiple SaaS vendors and prefer OPEX spending – CSP aligns perfectly with that mindset. The key is to find a CSP partner who can scale with you and provide guidance on optimizing costs (for example, as you add numerous Azure workloads, a partner can help automate the shutdown of unused VMs to save money, etc.). Microsoft has even created the MCA-E (which is essentially a direct contract version of CSP for certain large customers), but even that is based on the same flexibility concept.

- Hybrid Model – Combining EA and CSP: Some enterprises might deliberately choose a hybrid licensing strategy. For example, a global corporation might utilize an EA in regions or divisions where it has a large concentration of users and stable demand, but allow smaller acquired companies or remote branches to use CSP through local partners. Or an organization might sign an EA for its core products like Microsoft 365 E3 for all employees (to lock a good price and ensure compliance organization-wide), but then use CSP for things like Azure dev/test subscriptions, short-term project licenses, or new AI services they’re experimenting with. This combined approach can deliver both predictability and flexibility. It does add a bit of complexity (you’ll manage two channels), but if handled well, it can result in cost savings. For instance, keep baseline needs in EA (so you’re not paying premium for those) and handle spikes or trials via CSP. Microsoft is generally okay with this – though be mindful that if you have an EA, you often agree to certain enterprise-wide coverage (such as when you sign an EA for Office, typically covering all users with at least a base license). However, you can still introduce CSP for niche items that aren’t part of the company-wide commitment.

Ultimately, the best model may be a customized blend tailored to your specific scenario. Consider factors such as the size of your organization, growth trajectory, whether you have a lot of on-premises software to maintain, how much you value steady costs versus the ability to cut costs quickly, and how hands-on you want to be with license management.

Microsoft’s changes in 2025 basically force smaller enterprises to CSP, but larger ones still have a choice – and even they might find CSP beneficial for some use cases.

Renewal & Negotiation Tactics in 2025

Whether you’re sticking with an EA or moving to CSP, 2025 brings some new angles to consider when negotiating and planning renewals:

For EA Renewals:

- Timing and Eligibility: If you are one of those organizations near the cusp of Microsoft’s new eligibility cutoff, and you still have an EA, carefully assess if Microsoft will let you renew. It may be strategic to renew early (if possible) before any policy changes take effect fully. Some companies have managed to secure a final 3-year EA by renewing just before their current one expired, even if they had fewer than 2,400 seats, especially if they included some on-premises licensing to qualify. This could buy you time (until 2028) on a stable EA pricing. Work with your LSP or Microsoft rep to understand your options. If Microsoft signals that they won’t renew your EA, don’t waste negotiation capital trying to force it – instead, pivot to negotiating the best CSP deal.

- Leverage the Transition in Negotiation: If you do qualify to renew your EA, use the existence of CSP as a negotiation lever. Microsoft knows that if they don’t offer you acceptable EA terms, you could move your spend to a CSP partner (and Microsoft generally makes less margin and has less direct control in that scenario). Particularly highlight the fact that volume discounts are being phased out – ask for alternative concessions to compensate for this loss. For example, you may be able to negotiate a larger discount on a specific product family or secure some Azure credits. Also, highlight any pain points of moving to CSP (like splitting licensing, losing SA benefits) to justify why Microsoft should give a bit on pricing to keep you on EA. In essence, subtly let them know “we have options now, so we expect a good deal.”

- Renewal Before Price Changes: Microsoft has been adjusting prices regularly (including doing things like aligning global prices or adding premiums for local currencies). Keep an eye on announcements – if you know a price increase for certain products is coming in, say, February 2025, and your EA is due in June 2025, consider early renewal or placing an add-on order before the hike to lock in current pricing. Microsoft usually honors EA price locks for stuff ordered during the term. There’s also the November 2025 end of volume discounts to consider: any EA renewing after that will be at flat list prices. If you renew before that date, you might still get the old structure for that term. These timing nuances can mean significant cost differences.

- Negotiating Support: Remember that under EA, Microsoft doesn’t bundle support – you pay separately for Unified Support usually. If moving to CSP had gotten you free partner support, you might negotiate something like Microsoft giving a discount on a Unified Support contract if you stay EA. Or perhaps your LSP (who is also often a CSP provider) could be contracted to provide additional support even if you stay on EA. Basically, make sure you’re not paying unnecessarily for support if Microsoft wants to keep you as an EA customer.

For CSP Deals:

- Choosing and Negotiating with a CSP Partner: In CSP, you’re not exactly negotiating with Microsoft (prices are mostly set), but you can negotiate with the partner. If you’re a sizable customer, get quotes from a few reputable CSP providers. Compare not just the price, but the services they include. One partner might offer a 5% discount on licenses but minimal support, while another charges full price but provides a dedicated technical account manager and quarterly optimization reviews. Depending on your needs, the latter might save you more in the long run through cost management. Don’t be shy to ask for a volume discount or rebate from the partner, especially if you are bringing a large number of seats or Azure consumption. CSP margins are not huge, but for a big deal, partners often have some wiggle room or promotional funds from Microsoft that they can use.

- Billing Flexibility: Negotiate billing terms that suit your finance team. Some CSP partners can offer annual billing (even though they bill monthly from Microsoft, they can invoice you yearly if that’s easier for you) or extended payment terms. Ensure you understand how they handle true-downs (license reductions). With NCE, if you opt for annual subscriptions, you can’t reduce those mid-term, but you can mix a percentage of monthly to allow adjustments. Work out a plan: e.g., consider committing 80% of your expected annual need to achieve a lower cost, and reserve 20% as a monthly amount that you can adjust if needed. A good partner will help structure this, but you should bring it up.

- Service Level Agreements: When shifting to CSP, part of the negotiation involves support SLAs. Clarify with the partner their response times for critical issues, whether they offer 24/7 support, whether you will have a dedicated contact, and what the escalation path is for severe outages. While not the same as a pricing negotiation, getting these support promises in writing is important. If one CSP partner won’t guarantee a certain level of support but another will, that’s a factor to consider alongside cost.

- Use Microsoft’s Desire as Leverage: Interestingly, Microsoft encourages customers to migrate to CSP/MCA-E (for smaller organizations). In some cases, Microsoft might offer transition incentives. Ask your Microsoft account representative (if you have one) or contact the partner directly to inquire about any funding programs or discounts available for transitioning to CSP. Sometimes, they offer limited-time promotions (such as a specific Azure credit if you switch or a discounted first-year price on a particular product). These aren’t always publicly advertised, so it’s worth inquiring during negotiation.

- Migrating Data and Workloads: Plan the actual transition to avoid double payment. For example, if your EA ends on June 30 and you transition to CSP on July 1, ensure that you migrate all your users to the new subscriptions immediately so you’re not inadvertently still on EA licenses. Coordinate with the partner to migrate items such as Azure subscriptions (which can be transferred to a CSP tenant) and transition users’ licenses in the Microsoft 365 admin center to the new subscriptions with minimal disruption. This isn’t a negotiation point per se, but it’s a tactic to avoid any lost value or scramble at renewal time.

- Audit and Compliance in Transition: If you have an EA and are transitioning to CSP, consider requesting a final license reconciliation or a brief extension of your EA for a month or two, if needed, to sort out compliance. Microsoft sometimes offers a grace period if negotiations run long – you might not get that courtesy if you just lapse. So, negotiate the explicit alignment of the end date. And ensure any unused EA software licenses with perpetual rights are properly documented as you exit (so you know what perpetual licenses you still own post-EA – those you can keep using indefinitely even without EA).

By employing these tactics, you can make your renewal – whether EA or CSP – much smoother and more cost-effective. The main thing in 2025 is to be proactive: Microsoft’s changes are significant, so start the conversation early, run the numbers for different scenarios (EA vs CSP costs over 3 years), and don’t be afraid to push for extras. In a time of change, there’s often more flexibility to negotiate than during business-as-usual.

Decision Framework – EA or CSP?

When deciding between Microsoft EA and CSP for 2025, it helps to use a simple framework. Consider the following factors and questions to guide your choice:

1. Organization Size and Seat Count: How many users/devices are you licensing? If you’re well above the ~2,400 seat mark, you likely qualify for EA – and an EA probably makes financial sense to explore. If you’re below that, CSP will be the default. If you’re in a gray area (e.g., around 2,000-2,500 and growing), consider whether you will surpass the threshold soon or not. Also consider if all those users need the same set of products (EA is best when you want to standardize licensing for everyone).

2. Cloud Adoption Plans: Are you mostly cloud, mostly on-prem, or hybrid? If you’re cloud-heavy or cloud-first, CSP aligns naturally with your strategy. If you still rely heavily on on-premises software or require Software Assurance benefits for things like upgrades, then EA (or a combination of agreements) might better manage that complexity. Think about the next 3 years: are you trying to get rid of on-prem infrastructure entirely (if yes, CSP is fine), or do you need a bridge to slowly phase out on-prem (EA can serve as that bridge with SA benefits)?

3. Flexibility Needs vs. Long-Term Stability: Does your organization prefer flexibility in costs or consistency? Some companies have variable staffing or projects that ramp up/down – they should lean on CSP because it will allow costs to mirror activity. Others have relatively predictable operations and value steady budgeting – they might lean toward EA. Also consider your financial preferences: do you prefer spreading payments over the course of a year or making monthly operational expenses? EA will be more lump-sum (even if split into three annual payments, those are larger chunks), whereas CSP is evenly spread and can be treated as an ongoing operational expense.

4. Internal Licensing Governance Capability: If you have a strong license management team and processes, you can handle either model. If you do not have that and have relied on Microsoft or an LSP to keep you in check, then moving to CSP means you should lean on a partner heavily or risk things falling through the cracks. If compliance risk keeps you up at night and you want everything buttoned up in a single agreement, EA is attractive. But if you’re confident that your team (with a partner’s help) can manage a more dynamic environment, CSP is fine.

5. Support and Partner Needs: Determine how much external support you need. If you have a robust IT support organization and existing Microsoft support contracts, you might not need the hand-holding of a CSP partner – EA with a direct support line might suffice. If you prefer a high-touch support experience or to offload admin tasks, a CSP partner can provide that as part of their service.

Some organizations also weigh the relationship aspect: with EA, you often have Microsoft and a large LSP in the picture; with CSP, you might have a smaller dedicated partner who gives you more attention. Which is more valuable to you?

6. Cost and Negotiation Outlook: Do a projection: what would 3 years in EA cost vs 3 years in CSP, given your expected usage? Include any known price changes or the loss of volume discounts. If the costs are similar, then the other factors (such as flexibility and support) should drive the decision.

If one is clearly cheaper, that’s important too. Also consider your ability to negotiate: larger enterprises can negotiate better deals in EA; smaller ones won’t have that same leverage and may do just as well in CSP, where pricing is standardized.

Using the above criteria, you might find a clear answer or you might find a hybrid approach is best.

Write down your roadmap for the next few years:

For instance, “Year 1: still have some on-premise apps, Year 2: migrating to cloud, Year 3: fully cloud.” If that’s a scenario, perhaps a 3-year EA renewal (to cover the journey with hybrid rights) is a smart move, or maybe a short one-year renewal, followed by a move to CSP, is a better option. Conversely, if your roadmap is uncertain, CSP provides you with the flexibility to adapt as you go.

Also, plan for contingencies. Microsoft’s licensing programs will continue to evolve. It’s wise to maintain optionality.

For example, if you’re on EA, keep tabs on CSP developments and ensure you can transition with minimal disruption if needed (perhaps by not overly customizing your agreement or by keeping good records of your license assignments).

If you’re on CSP, stay aware of any new enterprise offers Microsoft might introduce (if, say, a new type of agreement or improved terms come out for mid-market) – you don’t want to be caught off guard.

In essence, an informed decision on EA vs CSP in 2025 boils down to aligning with your organizational profile and strategy.

Evaluate your size, cloud goals, need for flexibility, support structure, and cost implications. The right choice (or mix) will become clearer when weighed against these factors.

Related articles

- Microsoft EA vs CSP vs MCA-E Licensing Comparison

- Hybrid Licensing Strategy: Using Microsoft EA and CSP Together

- EA vs CSP Cost Comparison: Which Microsoft Licensing Model Saves More?

- Microsoft CSP Licensing: Flexibility, Pricing & Best Use Cases

- Microsoft Enterprise Agreement Explained: Structure, Benefits & Changes

- Microsoft EA Negotiation Tactics in How to Maximize Value Before Discounts End

FAQ – Microsoft EA vs CSP in 2025

Q: What’s the minimum seat count to qualify for a Microsoft EA in 2025?

A: Formerly, the minimum was still 500 seats to start an Enterprise Agreement. However, Microsoft has effectively raised the bar in practice. In 2025, companies with fewer than approximately 2,400 users will find it challenging to acquire a new EA or even renew an existing one, especially if their EA was primarily used for cloud services. Microsoft is encouraging those customers to go to CSP or the Microsoft Customer Agreement (MCA-E). So, while 500 is the technical minimum, expect to need roughly 2,400+ seats (and a mix of products, including perhaps some on-premises) to be offered an EA by Microsoft.

Q: Is an EA cheaper than CSP if both are negotiated well?

A: It depends on your situation. For large enterprises, an EA can absolutely be cheaper in terms of per-license cost because you can negotiate discounts, and you lock prices for three years (protecting against increases). Also, if you consistently use a high volume of services, EA’s fixed pricing can yield savings over the pay-as-you-go CSP approach. On the other hand, if you’re a smaller organization or your usage fluctuates, CSP might result in a lower total cost because you’re only paying for what you need and can avoid paying for unused licenses. Additionally, CSP partners might offer slight discounts or bundle services that add value. One scenario: if both EA and CSP are charged at list price (with no discounts), then EA could end up more expensive if you over-committed, whereas CSP would be exactly aligned to your actual usage costs. Generally, for a stable large deployment, EA (with a well-negotiated rate) tends to be more cost-effective over a multi-year period than CSP’s standard pricing. However, you must weigh the risk of over-provisioning (EA) against the risk of price increases and premium flexibility costs (CSP). When negotiated well, EA often beats CSP on unit price for equivalent services, yet CSP can save money by avoiding overspend on unused capacity.

Q: Can we combine EA with CSP for flexibility?

A: Yes, and many organizations do. Having an EA doesn’t lock you out of also using CSP. Common approaches include: using EA for the majority of licenses and using CSP for specific needs (such as a new project, a subsidiary company, or a temporary increase in users). Another example is using CSP for Azure dev/test subscriptions or non-production environments while production is covered under EA commitments. Microsoft permits this mixed approach, though you should ensure you’re not double-paying (each user/device should ideally be licensed under one program for a given product). Combining EA and CSP can deliver the best of both worlds: the cost predictability of EA and the agility of CSP. Maintain clear records of all purchases and their locations to ensure compliance. Also, if you have an EA, you might have enterprise-wide clauses (like “all users must be covered with XYZ license”). If you deviate using CSP, clear it with Microsoft or design it so it doesn’t violate your EA terms.

Q: How do I manage compliance and audits under CSP?

A: In CSP, compliance for cloud services is largely automatic – you can’t really use more cloud licenses than you purchased because the systems won’t allow it. However, compliance still matters if you are using any on-premises software or hybrid benefits. To manage compliance under CSP, you should:

- Keep track of any perpetual licenses you still use (perhaps bought via CSP or that carried over from a prior EA). You might still be subject to audit on those.

- Ensure that when you remove a user from a subscription, they are prevented from continuing to use the service. For example, if someone had Visio via CSP and you dropped that subscription, ensure they didn’t install a local copy that you forgot to uninstall – although unlikely, it’s worth checking.

- Coordinate with your CSP partner to get regular reports of your subscriptions and usage. Many partners provide dashboards or reports that show license assignments, allowing you to identify unused licenses (which can be removed to save costs) or instances of unnecessary license duplication.

- Understand Microsoft’s terms under the MCA – even under CSP, Microsoft can audit your usage of their services if they suspect misuse (e.g., using a product outside the scope of the license terms). Ensure that your administrators only assign licenses in authorized ways (for instance, don’t attempt to assign a single user’s license to two people interchangeably – each subscription is either per user or per device, as specified).

In short, while CSP reduces a lot of compliance headaches by its design, you’ll still want an internal process to review licensing monthly or quarterly. Most audits in the CSP era might focus on hybrid use rights – e.g., if you claim Azure Hybrid Benefit, ensure you actually have eligible licenses. Keeping documentation of any such claims will protect you in the event of an audit.

Q: Will moving to CSP impact the hybrid cloud licensing rights we used to get in EA (like use of on-prem software)?

A: Potentially, yes. Under an EA with Software Assurance, you enjoyed many hybrid rights: like the ability to run current or earlier versions of software on-prem, to move workloads to Azure with hybrid benefits, or to use dual-use rights during a transition. If you fully transition to CSP subscriptions, ensure you obtain equivalent rights if you still require them. Some examples:

- If you had Windows Server licenses with SA for your data center, and you drop those for, say, Windows Server subscriptions in CSP, note that CSP server subscriptions do include rights to run Windows Server. Still, if you ever stop subscribing, you lose the rights (whereas perpetual licenses with SA could be kept perpetually). Additionally, some advanced SA benefits, such as cold backup licensing, may not be available under CSP.

- For client software: If you move from Office Pro Plus licenses with SA to Microsoft 365 Apps through CSP, you still can install Office on-premises (since Microsoft 365 Apps is basically an Office subscription), so that’s fine. However, if you have a Windows 10 Enterprise upgrade license via EA under CSP, you might consider using a Windows Enterprise E3 subscription instead. That gives similar rights (including to upgrade and use the OS on a device), but ensure you understand if things like Virtual Desktop Access rights or other SA perks are included. Microsoft 365 E3/E5 subscriptions do include most of those rights.

- One notable loss could be the “From SA” discounted pricing you had in EA for moving to the cloud. Once in CSP, if you haven’t already utilized those discounts, you’ll pay full price for the cloud subscriptions. That’s less a “rights” issue and more a cost issue, but it’s related to the transition from hybrid benefits under EA to pure subscription under CSP.

Overall, most hybrid capabilities are still available in CSP in some form, but you may need to reconfigure how you access them.

Check if Microsoft offers a bridge SKU in CSP for what you need, or if you should retain a skeleton EA or Open Value agreement for certain on-premises pieces.

Don’t assume every SA benefit automatically carries over in CSP – verify case by case.

If you’re not careful, you might lose valuable benefits, such as long-term downgrade rights or the ability to spread out an upgrade deployment.

Q: What negotiation tactics work best if migrating from EA to CSP?

A: When moving from EA to CSP, you aren’t exactly negotiating with Microsoft in the same way, but you can leverage a few tactics:

- Create a competitive environment among CSP partners: Contact multiple providers and inform them that you are considering your options. This may encourage them to offer better discounts or additional services to win your business. Even if Microsoft sets base prices, partners have levers like free migration support, training offers, or a percentage discount for the first year.

- Ask for Microsoft involvement: Sometimes, if you’re a sizable account transitioning, Microsoft may have funds available to assist (for example, deployment funding or an incentive to help you migrate to cloud subscriptions). Contact your Microsoft representative or have your partners check if any such programs exist. Microsoft ultimately wants you to stay within their ecosystem (EA or CSP), so during the transition, they may be willing to assist.

- Negotiate contract flexibility: While you can’t change Microsoft’s customer agreement, you can negotiate things like a shorter initial term with a CSP partner (maybe try a 1-year CSP contract before committing longer with that partner, just to ensure service quality). Also, ensure there’s an easy exit clause if you’re not satisfied (you don’t want to be stuck with a poor partner).

- Data Handling and Transition Plan: Include in the agreement that the CSP partner will assist in a smooth transition from EA. Get clarity (even in writing) on how they will transfer workloads, how they handle your data (especially if moving Azure subscriptions – what tools or guarantees they provide). This is less about price and more about ensuring they do the heavy lifting for you as part of the deal.

- Use future potential as leverage: If you anticipate increasing your cloud usage, mention this to the partner. They will view you as a growth opportunity and may offer concessions now in exchange for a promise of more business later (even if informal).

Essentially, approach CSP migration as a procurement exercise where the partners are vying for your business. And keep Microsoft in the loop – occasionally, they might step in with advice or incentives since they ultimately still get the revenue (just through a partner).

Q: Do we keep Software Assurance when moving to CSP?

A: Not in the traditional sense. Software Assurance (SA) is a program tied to perpetual licenses or enterprise agreements. When you move to CSP, you’re mostly buying subscription licenses, which inherently include certain benefits for as long as you subscribe. For example, a Microsoft 365 E5 subscription includes the right to upgrade to new versions (because it’s evergreen), which is something a perpetual license would not have provided. However, there are a few nuances:

- If you have existing perpetual licenses with SA and you discontinue the EA, you lose the SA on those (once it expires). You will still retain the perpetual licenses for the last version, but you won’t receive any further upgrades or benefits. There is no way to attach SA to a CSP subscription; instead, you would just use subscriptions going forward.

- Some SA-like benefits, as noted, are built into certain subscriptions: e.g., Windows Enterprise subscription covers what Windows SA used to (like use of Windows Enterprise edition, virtualization rights, etc.), Microsoft 365 covers what Office SA used to (like roaming use rights, home use, etc., though some of those programs have changed).

- If you still require SA for some reason (such as server software upgrades), you may need to purchase those licenses outside of CSP, as CSP’s focus is on subscription-based services. CSP does allow the purchase of certain perpetual licenses, and you can add SA to them via “Software Assurance through CSP” for specific products. However, this is relatively new and not as commonly used. If you truly need SA, another strategy is to opt for an Open Value agreement or to stay on EA for just those parts, as that may sound confusing. But generally, once you move to CSP, you’re moving away from the SA model to the subscription model.

In essence, you don’t “keep” SA when moving to CSP because CSP is a different paradigm. You replace the need for SA by using subscriptions that automatically stay up to date.

Just be mindful if there’s any niche SA benefit you relied on (like training vouchers or home-use program); you may need to find alternatives for those in the CSP world (Microsoft now often provides training resources free, or partners might help with training, and home use is now basically just that users can install Office 365 at home via their subscription).

Read about our Microsoft EA Optimization Service.