Microsoft EA vs CSP vs MCA-E: Choosing the Best Licensing Model for 2025

Overview of Microsoft’s Licensing Landscape in 2025

Microsoft’s licensing landscape is evolving rapidly in 2025. The company is actively phasing out some traditional licensing programs (like certain Enterprise Agreements) for mid-sized customers in favor of newer, cloud-focused models.

This means enterprises and mid-market organizations must re-evaluate their Microsoft licensing strategy now. The wrong choice can lead to unnecessary cost increases or compliance issues, especially as Microsoft shifts to subscription-centric agreements.

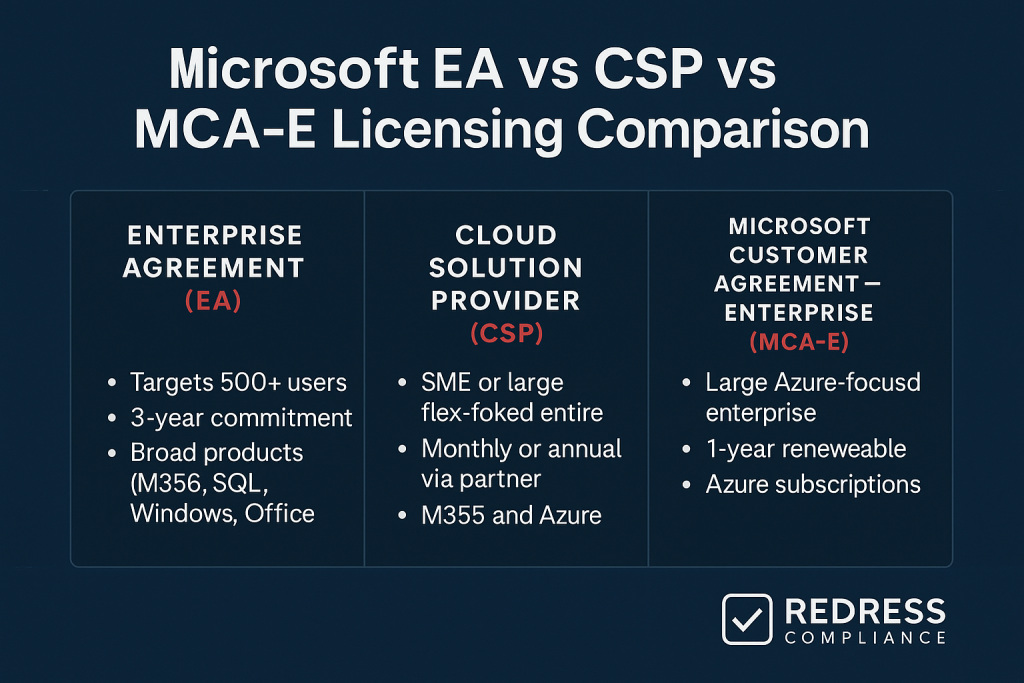

In this guide, we’ll compare the three major licensing models available today – the Enterprise Agreement (EA), Cloud Solution Provider (CSP), and Microsoft Customer Agreement – Enterprise (MCA-E) – to help you choose the best fit for your organization’s needs and cloud roadmap.

For a full overview – Microsoft EA vs CSP: The Ultimate Guide

What Is a Microsoft Enterprise Agreement (EA)?

The Enterprise Agreement (EA) is Microsoft’s classic volume licensing contract designed for large organizations.

An EA is a 3-year agreement that typically requires a commitment of around 500 or more user/device “seats” (and in practice, Microsoft now targets enterprises with 2,400 or more seats for new EAs).

Under an EA, a company agrees to license Microsoft products (such as Windows, Office/Microsoft 365) for all qualifying users or devices across the enterprise.

Key features include:

- Volume Pricing & Discounts: EAs offer tiered volume discounts (Levels A–D) – larger seat counts historically earned bigger discounts off list prices. Pricing for all licenses is locked for the 3-year term, protecting against Microsoft’s price increases during that period.

- Software Assurance (SA): Enterprise Agreements include Software Assurance by default on licensed products. SA provides benefits like version upgrades, training credits, and hybrid use rights for on-premises software. For example, with SA you can run the latest Windows/Office versions on-premises or use Azure Hybrid Benefits for servers.

- Predictable Spend: Since pricing and quantities are fixed (with annual adjustments for growth), budgeting is straightforward. You typically pay annually (or upfront) for your committed licenses, and you know the costs for three years.

- True-Up (and Limited True-Down): Each year, you report any increase in usage (new employees, extra licenses) and pay a pro-rated amount – this is the annual true-up. This process is a safety net ensuring compliance without requiring you to pre-pay for growth you might not need. In some cases, you can reduce certain subscription counts at the anniversary if your usage has dropped (though reductions are limited and must remain above the contract minimums).

- Negotiated Protections: With an EA, you sign a comprehensive contract (often 30+ pages) directly (via a Licensing Solution Provider). Large customers can negotiate special terms, such as extended support, custom privacy or liability clauses, or unique discount arrangements. An EA provides strong governance and legal protections that are not typically available in lighter-weight agreements.

Limitations of EA in 2025:

The EA’s rigidity is its downside. You’re locked into a three-year commitment – if your company downsizes or you want to drop a product, you generally can’t reduce your license count until renewal. The upfront commitment can lead to “shelfware” (unused licenses) if overestimated.

Additionally, Microsoft is discontinuing EAs for mid-market customers (those with fewer than 2,400 seats), which means these organizations may no longer be offered an EA at renewal. Even for large enterprises, Microsoft is standardizing pricing (ending some volume discount tiers by late 2025), which reduces the automatic cost advantage of an EA.

In short, an EA still makes sense for many large enterprises that need predictable costs and on-premises rights, but it offers far less flexibility. It is becoming increasingly exclusive to the biggest customers.

What Is Microsoft CSP (Cloud Solution Provider)?

The Cloud Solution Provider (CSP) program is Microsoft’s modern, partner-led licensing model. Instead of a direct contract with Microsoft, you purchase licenses and cloud subscriptions through a Microsoft partner (reseller) who manages the billing and support.

CSP is part of the new commerce system and has no minimum seat requirement – it’s open to organizations of any size, from 5 users to 50,000.

Key characteristics of CSP include:

- Subscription Flexibility: CSP operates on a subscription basis. You can choose monthly, annual, or multi-year subscription terms for each product. This means you can scale licenses up or down more easily. For example, you might opt for month-to-month Microsoft 365 licenses, which allow you to adjust user counts every month. (Annual-term subscriptions in CSP provide price consistency for a year, while month-to-month subscriptions cost about 20% more but give ultimate flexibility.)

- No Long-Term Contract: Unlike an EA, there is no three-year master contract required. CSP is an evergreen arrangement – you’re simply buying what you need, when you need it, and you can cancel or modify subscriptions at the end of their term. This agility is ideal if your user count fluctuates or you want to avoid being locked into a long deal.

- Partner Value-Add: A significant advantage of CSP is the support and services provided by the partner. The CSP reseller often provides front-line support, assists with license management, and may bundle in consulting or managed services. For organizations without internal licensing experts, a good CSP partner serves as an extension of your IT team, handling provisioning, optimization, and troubleshooting of Microsoft services.

- Quick Access to New Services: CSP is closely aligned with Microsoft’s cloud storefront. New Microsoft cloud offerings (Azure services, new Microsoft 365 add-ons like AI features, etc.) appear in CSP as soon as they’re released. You can trial or add new products on the fly, without waiting for a yearly EA order window.

- Cash-Flow Friendly: Instead of large upfront payments, CSP typically bills monthly (or as arranged with your partner). This pay-as-you-go model can improve cash flow and align costs to actual usage, an OpEx approach that many finance teams prefer for cloud services.

Drawbacks of CSP:

The flexibility of CSP can come at a higher per-unit cost. Pricing in CSP is generally based on Microsoft’s standard list prices (the partner can offer a discount from their margin, but you won’t get the kind of deep volume discounts an EA might provide for a huge enterprise deal).

Also, Microsoft imposes premiums for flexibility – for instance, a monthly subscription term is ~20% more expensive than an annual term for the same product, and paying month-to-month on an annual commitment may incur a small finance charge.

Over time, if you keep licenses continually active, CSP could cost more than an EA would have for the same quantity.

Another consideration is the lack of Software Assurance in CSP. Most CSP licenses are cloud subscriptions (which inherently include updates), but if you need on-premises software rights or upgrade guarantees, CSP doesn’t include those SA benefits.

Some perpetual licenses can be bought via CSP (e.g., a one-time purchase of a server license), but those come without SA and limited upgrade options.

This means that purely using CSP might not cover certain legacy or hybrid scenarios – e.g., you’d need existing Windows/SQL licenses with SA or subscription equivalents to use Azure Hybrid Benefit, since CSP itself doesn’t provide SA.

Lastly, partner dependency is a factor: your experience depends on the partner’s reliability. If the CSP partner is unresponsive or you want to switch providers, it can introduce complexity (though switching is possible, it may require transferring subscriptions to a new partner).

Despite these drawbacks, CSP is highly popular among mid-sized and growing organizations due to its agility and hands-on support model.

For more strategic insights – read Hybrid Licensing Strategy: Using Microsoft EA and CSP Together.

What Is Microsoft MCA-E (Microsoft Customer Agreement – Enterprise)?

Microsoft Customer Agreement – Enterprise (MCA-E) is Microsoft’s newest purchasing program and can be seen as the direct, digital evolution of the traditional EA.

Under an MCA-E, you sign a simplified Microsoft Customer Agreement directly with Microsoft (no reseller intermediary for the contract).

Then you purchase cloud services on an ongoing basis, similar to CSP. The MCA-E is an evergreen agreement (with no fixed end date) and is managed through Microsoft’s commerce portal.

It was initially introduced for Azure purchases and is expected to expand to cover Microsoft 365, Dynamics 365, and other cloud subscriptions by 2025.

Key aspects of MCA-E include:

- No Seat Minimums or Volume Requirements: Like CSP, the MCA-E does not require a minimum number of users. This makes it accessible to organizations that previously might not have qualified for an EA. It’s particularly aimed at enterprises that want a direct relationship with Microsoft without a traditional EA.

- Flexible, Modular Purchasing: Under MCA-E, you can add or remove subscriptions (licenses) as needed, choosing monthly or annual terms for each (much like CSP’s model). There’s no organization-wide coverage mandate – you purchase what you need for the users who require it. This enables the incremental adoption of services and facilitates easy scaling.

- Direct Billing and Management: With an MCA-E, Microsoft bills you directly (often in USD for all regions, which is something to be mindful of for currency exchange impacts). You manage your subscriptions in Microsoft’s portals. This eliminates the reseller’s role in transactions – some companies prefer direct control and a direct line to Microsoft for sales and support escalations.

- Alignment with Cloud Consumption: The MCA-E is well-suited for cloud-first organizations. For example, Azure under MCA-E can be purchased on a pay-as-you-go basis or via an Azure consumption commitment. If you commit to spending a certain amount on Azure or other Microsoft services, the company may provide corresponding discounts or benefits. However, unlike an EA, these are negotiated on a case-by-case basis rather than being built into tiers.

- Simplified Contract: The Microsoft Customer Agreement is much shorter and more streamlined than an EA contract (on the order of 8–10 pages, digitally accepted). It covers general terms once, and as you add products, their specific terms append automatically. This reduces legal complexity and speeds up procurement, eliminating lengthy negotiation cycles for each renewal.

Cons and Considerations of MCA-E: The MCA-E’s flexibility comes with some trade-offs. First, it eliminates traditional volume discounts and price locks. There are no tiered pricing levels – even a large enterprise pays essentially the same catalog price as a smaller customer, unless you negotiate a special concession.

Pricing for cloud services under MCA-E can adjust in line with Microsoft’s public pricing (for instance, Azure usage rates or Microsoft 365 list prices may rise year to year, and there is no 3-year lock, unlike an EA).

Budgeting thus requires more attention to potential price fluctuations.

Key Comparison – EA vs CSP vs MCA-E

To decide between an EA, CSP, or MCA-E, it helps to compare them across key factors. Below is a side-by-side comparison of the models:

- Contract Length & Commitment: EA is a fixed 3-year contract. CSP and MCA-E are both open-ended (no overall term) – you can add/cancel subscriptions as needed without a multi-year lock-in.

- Seat Thresholds: EA requires a sizable user count (generally 500+ seats, and in 2025, effectively 2,400+ for new deals). CSP has no minimum – it works for any number of users. MCA-E also has no minimum, allowing even mid-sized firms to contract directly with Microsoft.

- Pricing & Discounts: EA offers volume-discounted pricing (with tiered levels) and locks prices for 3 years – historically giving large enterprises the lowest per-user costs. The partner sets CSP pricing, but it is largely based on Microsoft’s standard rates (list price), with no built-in volume discounts (partners may give small discounts from their margin). Microsoft sets MCA-E pricing at a standard rate for all customers (no tier levels), so big customers no longer automatically get a lower price unless they negotiate something like an Azure commitment deal. All models allow custom discounts for huge deals, but programmatically, EA had an edge that is now shrinking.

- Payment & Billing: EA customers are billed by Microsoft, typically on an annual basis (or upfront) for each year of the term. CSP customers are billed by the partner, typically on a monthly or annual basis, as per your subscription choices – offering more granular billing cycles and even usage-based billing for Azure. MCA-E customers are billed by Microsoft with monthly or annual invoices, depending on the service (Azure tends to be monthly based on consumption; seat licenses could be annual or monthly subscriptions). CSP often offers the most flexible billing arrangements (since partners can sometimes custom invoice or align with your preferred schedule).

- Flexibility to Add/Remove Licenses: EA: You’re committed to an initial quantity for 3 years; you can increase licenses anytime (true-up) but generally can only reduce at the very end (with limited exceptions at anniversaries for certain subscriptions). CSP: You can usually true-up or true-down month-to-month for monthly term licenses, or at each annual renewal for yearly subscriptions. This means you’re never far from an opportunity to right-size your license count. MCA-E: Similar to CSP, you can adjust subscriptions at the next billing cycle or term end – e.g., drop users at the end of a month or year term. In short, CSP/MCA-E offers significantly greater agility in responding to changing needs.

- On-Premises Software & Hybrid Rights: EA excels here – it can include perpetual on-prem licenses with SA (Windows, Office, SQL, etc.) and gives you hybrid use benefits (like using existing licenses in Azure). You have the right to the latest software on-prem throughout the term via SA. CSP is mainly cloud subscriptions; while you can buy some on-prem perpetual licenses through CSP, they come without SA and are limited. Hybrid benefits (e.g., Azure Hybrid Benefit) require you either to have an existing SA or to use specific CSP subscription licenses that include that right. MCA-E is cloud-only for new purchases – it does not offer traditional on-prem + SA licenses. If you need to maintain on-prem servers or older software versions, you’d need a separate legacy agreement or plan a transition to cloud equivalents. For a hybrid environment, an EA or a mix of agreements might be necessary; CSP/MCA-E alone might leave gaps for on-premises needs.

- Support & Account Management: EA contracts do not automatically include support; enterprises typically purchase a Premier/Unified Support plan or rely on their reseller for assistance. You do get a Microsoft account team with an EA (for sales/renewal needs), but day-to-day support is separate. CSP includes support from the partner as part of the service – you contact your CSP provider for issues, and they will escalate to Microsoft if needed. Many CSP partners also proactively assist with deployment and optimization as part of their offering. MCA-E puts support in the customer’s hands: you’d use Microsoft’s standard support channels or purchase a support plan, since there’s no partner by default. Essentially, CSP offers a more managed service experience, whereas EA and MCA-E are more self-service (unless you add paid support).

- Governance & Negotiation: EA is a negotiated enterprise contract – you have room to negotiate terms and special provisions if you’re a large customer. It provides a robust legal framework (defining use rights, compliance, audits, etc.) tailored to enterprises. CSP is governed by Microsoft’s standard customer agreement plus whatever general contract you have with the partner – less room for custom negotiation on the Microsoft terms (they’re standardized). However, you may be able to negotiate service terms or discounts with the partner. MCA-E uses a standard Microsoft Customer Agreement for all, which means minimal flexibility to change terms – it’s designed to be the same for everyone and auto-renewal. You might negotiate some pricing or incentives with Microsoft (especially for large Azure commitments), but you won’t get the kind of bespoke contract language you might in an EA. For organizations with strict compliance or legal requirements, this is a consideration – an EA can be more tailored to your needs, whereas CSP/MCA-E are one-size-fits-most (with the trade-off of simplicity).

Which Model Fits Best? EA vs CSP vs MCA-E by Organization Size

Large Enterprises (approx. 2,400+ seats):

If you’re a very large enterprise, an EA may still be the most beneficial model in 2025. Large organizations with thousands of users can leverage the EA’s scale for negotiated discounts and enjoy the predictability and comprehensive coverage (especially if you have a mix of cloud and on-premise needs).

Microsoft continues to offer EAs to its largest customers – and you likely have an established process for true-ups and license management.

That said, even large enterprises are starting to consider splitting certain workloads between CSP and MCA-E. For example, some organizations keep their Microsoft 365 under EA for stability but move Azure consumption to an MCA-E to gain more flexibility in cloud spending.

Others might use CSP for specific projects or subsidiaries where they want a partner’s active support. In general, if you’re a large enterprise with a mostly steady workforce and significant annual spend, an EA provides cost control and executive-level engagement from Microsoft.

Just plan for the fact that at your next renewal, the built-in EA discounts for cloud services may diminish (as Microsoft moves everyone to level A pricing) – so be ready to negotiate or consider augmenting with other models for cost savings.

Mid-Market Organizations (500–2,400 seats):

For mid-sized companies, the landscape is shifting the most. Historically, many in this range have used EAs (Level A) to obtain some discounts and centralized control. Now, Microsoft is steering these customers to CSP or MCA-E instead of renewing EAs, especially if you’re fully cloud-based. If you’re in this seat range, you should actively compare the costs: sometimes a CSP deal can be cost-neutral to an EA when you factor in the ability to reduce unused licenses and avoid over-provisioning.

CSP is often attractive here because you get partner support and you only pay for what you need. It can also simplify admin (no more annual true-up paperwork).

Cloud-First or Smaller Organizations: If your organization is cloud-native or below the traditional EA size, an EA likely isn’t on the table. CSP is generally the go-to for small and medium businesses due to its ease of entry and month-to-month flexibility. Even some larger, tech-savvy companies that could qualify for EA choose CSP to avoid long-term commitments and maintain their flexibility in a rapidly changing tech environment.

MCA-E could be appealing to a cloud-first company that doesn’t need a partner’s help and wants direct control — for example, a tech company with 300 employees might directly buy Azure and Microsoft 365 via MCA-E to have central visibility and potentially negotiate Azure consumption credits.

However, keep in mind that MCA-E is relatively new; smaller companies may not receive the same level of Microsoft sales attention as large enterprises, so the partner route (CSP) could offer more hands-on service. In any case, for cloud-centric orgs, both CSP and MCA-E deliver the subscription model you need; the decision comes down to whether you value a partner-managed experience or a direct contract with Microsoft.

Mixing Models:

It’s Not an All-or-Nothing Choice. Many enterprises use a mix of licensing models to optimize both cost and flexibility. For example, a corporation might maintain an EA for core user licenses (to lock pricing for Microsoft 365 E5 for 5,000 employees) but buy Azure via CSP or MCA-E to take advantage of pay-as-you-go billing and avoid overcommitting to cloud spend.

Similarly, if you’re mid-transition, you might keep an EA for on-premises licenses and Software Assurance (e.g., for Windows/SQL Server) while moving new cloud services into CSP.

Microsoft’s programs are not mutually exclusive – you can have an EA and also purchase other services through CSP/MCA concurrently. This approach can ease migration: you gradually shift to cloud subscriptions under CSP/MCA-E as your EA components phase out.

Ensure coordination across these channels to maintain compliance and prevent duplicate payments for all users. Mixing models can deliver the best of both worlds: the discount and coverage benefits of an EA where needed, plus the agility of CSP/MCA-E for new or variable workloads.

Strategic Guidance for 2025 Buyers

Selecting the right licensing model in 2025 requires a strategic assessment of both your current state and plans.

Here are some guidance points to consider as you evaluate EA vs CSP vs MCA-E:

- Assess Your Needs and Roadmap: Take inventory of your environment. How many users and what products do you have? Are you mostly cloud, or do you still need on-premise software and SA benefits? If your goal is to transition to 100% cloud within the next year or two, a flexible model like CSP or MCA-E will align better. If you have stable, long-term deployments, an EA might still serve you well until those systems are phased out.

- Model the Costs: Before your EA renewal or any switch, model a few scenarios to understand the potential costs. Compare the 3-year total cost of an EA (including any negotiated discounts) against the equivalent in CSP or MCA-E. Remember to factor in items such as CSP partner fees (if applicable), potential EA true-up costs, and the value of flexibility. Often, enterprises are surprised to find that once volume discounts are removed, CSP/MCA-E could be similar or cheaper if they right-size licenses over time.

- Beware of Rushed Transitions: Avoid simply rushing off an EA because Microsoft suggests it. Moving from an EA to CSP/MCA-E without proper planning can result in cost increases of 15–30%, typically due to organizations failing to optimize license counts or losing discounts on certain products. If you do transition, ensure you’re not carrying unnecessary licenses into the new model – use the opportunity to eliminate shelfware or downgrade unused services. Also, check for any features you might lose (for example, if you had “From SA” discounted licenses or training benefits under EA, plan how to replace those).

- Use Negotiation Leverage Wisely: In 2025, Microsoft is still eager to secure cloud commitments. Large customers can negotiate transition incentives. For instance, if you move to MCA-E, you might negotiate an Azure consumption credit or a locked discount in exchange for a committed spend. Even in CSP, if you are a sizable client for a partner, you can request a better rate or have additional services bundled at no extra cost. The key is to negotiate before signing onto a new agreement. Don’t assume the first offer is the best – especially if you have a significant Microsoft footprint.

- Consider Timing and Microsoft’s Changes: Monitor licensing program updates closely. Microsoft’s price increases (such as the one in 2025, adjusted for currency) or policy changes (like ending EA price tiers in November 2025) can tip the scales. Plan your moves around those milestones. For example, if your EA renewal is after the tiered pricing ends, you may face higher EA renewal costs, which makes exploring CSP/MCA-E early a smart idea. Conversely, locking an EA renewal just before a price hike could secure lower prices for three more years.

- Stay Compliant During Model Adjustments: As you modify models, ensure you maintain compliance. If you mix EA and CSP, keep track of which users are licensed under which agreement to avoid any gaps in coverage. Microsoft’s audit expectations still apply – but note that under CSP/MCA-E, you are in a continuous compliance mode (no annual true-up, you must license as you go). Establish internal governance to ensure that whenever new employees join or projects commence, a clear process is in place to assign licenses through the correct channel.

- Leverage Expert Advice if Needed: 2025 is a year of significant transition for Microsoft licensing. Don’t hesitate to involve a licensing expert or consultant (or your Microsoft account team and partners) to review your options. They can often identify cost-saving moves or point out pitfalls (like losing certain benefits). A strategic licensing plan will yield both savings and smoother operations.

By taking a thoughtful, informed approach, you can turn Microsoft’s licensing changes into an opportunity – potentially reducing costs and increasing your agility.

The goal is to align your agreement with your organization’s direction: whether that’s maximizing discounts for a stable environment or maximizing flexibility for a cloud-first journey.

FAQ – Microsoft Licensing Models in 2025

Q: Is Microsoft finally phasing out the Enterprise Agreement?

A: Microsoft is phasing out the EA for many mid-sized customers (generally those under ~2,400 users or with cloud-only needs). Starting in 2025, such customers are being directed to the MCA-E or CSP instead of renewing their EAs. However, the EA is not gone completely – it remains in play for large enterprises and public sector clients. Microsoft’s long-term aim is to modernize agreements, so we may see the EA evolve or be offered more selectively, but big organizations can still use EAs for now.

Q: Does CSP always cost more than an EA?

A: Not always, but often on a per-license basis, EAs have been cheaper for large volumes. An EA offers volume discounts and fixed pricing, whereas CSP is typically at the list price (plus any partner discount) and is subject to Microsoft’s price increases over time. That said, CSP can save money by allowing you to drop unused licenses and avoid over-purchasing. If your user count fluctuates or you have a lot of unused licenses under EA, CSP could actually reduce waste and be a cost-effective solution. With Microsoft eliminating some EA discounts in 2025, the gap is closing. The bottom line: if you can efficiently manage usage, CSP’s flexibility can offset its higher sticker price. For a stable environment where you can fully utilize a discounted bulk license purchase, EA historically had the edge.

Q: How is MCA-E different from CSP?

A: MCA-E and CSP are similar in that both use Microsoft’s new commerce platform and offer subscription flexibility, but the key difference is who you buy from and who manages the relationship. In CSP, you purchase through a partner, who handles your billing, support, and may offer additional services. With MCA-E, you purchase directly from Microsoft under the Microsoft Customer Agreement. There’s no reseller middleman in MCA-E. Practically, this means MCA-E gives you a direct line to Microsoft and one less party involved, which some enterprises prefer for control and simplicity. CSP, on the other hand, may provide you with more personalized support, as a partner is incentivized to provide close assistance. Pricing can also differ: in CSP, a partner might offer a slight discount or bundle, whereas MCA-E pricing is standardized by Microsoft (although you may be able to negotiate if you’re large enough). Both have no seat minimums and allow monthly/annual subscription terms. Ultimately, it comes down to whether you prefer a partner-managed experience (CSP) or a direct contract with Microsoft (MCA-E) for your cloud services.

Q: Can enterprises combine EA, CSP, and MCA-E agreements?

A: Yes. Many enterprises in 2025 are using hybrid licensing approaches. Microsoft doesn’t forbid using multiple programs concurrently – in fact, it’s common. For example, a company might maintain an EA for core software licenses (to get legacy software coverage and a stable price for Microsoft 365) while using CSP for specific cloud projects or smaller affiliates that need flexibility. An organization may adopt MCA-E for Azure and new cloud subscriptions, while still maintaining an EA that covers certain on-premises licenses until those are phased out. The key to managing agreements effectively is to coordinate purchases carefully, avoiding duplication, and keeping track of which users or workloads are under which license pool. By combining models, enterprises can tailor Microsoft licensing to specific workloads – just ensure you have robust asset management practices to prevent anything from falling through the cracks.

Q: Which licensing model is best for accelerating cloud adoption?

A: If your primary goal is to rapidly adopt cloud services and only pay for what you use, a flexible subscription model like CSP or MCA-E is generally the best fit. CSP is great if you want a partner to help manage the transition to cloud – they can provide migration services and adjust licenses as you ramp up usage. MCA-E is ideal if you’re confident going direct with Microsoft and possibly negotiating cloud spend commitments for discounts. Both models allow you to start small and scale quickly without a long-term contract. An EA can support cloud adoption too (you can include Azure and Microsoft 365 in an EA), but it’s less nimble – you have to predict your needs in advance. For a cloud-first strategy in 2025, many organizations find the CSP/MCA-E approach aligns better with agile, DevOps-oriented cloud growth. You can spin up new services, add users, or try new Microsoft cloud offerings immediately, and then scale down if needed, all without waiting for an EA true-up or renewal. So, while each situation is unique, CSP or MCA-E would typically be the top choices for a cloud-driven roadmap.

Read about our Microsoft EA Optimization Service.